Introduction

Financial Technology: Methods and Practice

Lorenzo Naranjo

Spring 2026

About Me

- Education

- BS and MS in Engineering from PUC Chile

- PhD in Finance from NYU Stern

- Research Interests

- Asset Pricing, Commodities, Corporate Restructuring, Derivatives, Fixed-Income

- At WashU

- I teach derivatives, investments and quantitative finance courses.

- I am the Academic Director of the MS in Quantitative Finance and MS in FinTech

- Before joining WashU, I taught at ESSEC Business School in Paris and University of Miami.

Teaching

- Undergraduate

- Financial Technology: Methods and Practice (FIN 4506)

- Investments (FIN 4410)

- Options, Futures and Derivative Securities (FIN 4510)

- Graduate

- CFAR Practicum (FIN 5019)

- Data Analysis for Investments (FIN 5321)

- Derivative Securities (FIN 5241)

- Financial Technology: Methods and Practice (FIN 5506)

- Fixed-Income (FIN 5250)

- Investment Theory (FIN 5320)

- Options and Futures (FIN 5240)

- Quantitative Finance Projects (FIN 5560)

- Stochastic Foundations for Finance (FIN 5380)

- Topics in Quantitative Finance (FIN 5018)

- Online Graduate

- Data Analysis for Investments (FIN 6533) and Options and Futures (FIN 6524)

Teaching Philosophy

- Your success is important to us!

- Applied course

- Emphasis on practice

- Goal

- Learn important trends in Financial Technology

- Acquire tools in machine learning and artificial intelligence

- Approach

- Practice

- Intuition

Nutshell

- The course is focused on the interplay between finance, business and technology

- Finance allows:

- People to save and borrow to smooth consumption

- Firms to raise funds to engage in productive activities

- Governments to finance public activities

- Finance also helps agents and firms managing risks

- Trading is a friction at the core of the financial system

- Technology can help!

Examples

- Bank wire transfers

- Credit cards

- Stock price quotation

- Interbank payment systems

- Electronic stock and futures trading

- Online brokers and banking

- Crypto currencies and blockchain

- Mobile banking

- Credit scoring

Small Case Study: Electronic Trading

- Stocks and futures use to trade physically

- Stock exchanges: trading floors

- Futures exchanges: trading pits

- Today all trading in exchanges is electronic

- Futures exchanges in the U.S. were the first to implement this

- Before electronic stock exchanges in the U.S. there were Electronic Communication Networks (ECN)

📈 Equities-Focused Exchanges

- These primarily list and trade stocks (equities) and many also handle ETFs and other listed securities:

- NYSE – New York Stock Exchange — Core equities marketplace (largest U.S. exchange).

- Nasdaq Stock Market — Major electronic equities exchange.

- NYSE Arca — Trades equities & ETPs (also supports options on the Arca options market).

- NYSE American — Equities exchange (small/mid-cap; also hosts an options market).

- NYSE National — Equities trading venue.

- Cboe BZX Exchange — U.S. equities trading platform.

- Cboe BYX Exchange — Equities focus.

- Cboe EDGA Exchange — Equities platform.

- Cboe EDGX Exchange — Equities trading.

- Investors Exchange (IEX) — Focused on equities trading.

- MEMX, LLC — Equities exchange (and now has a connected options market).

📊 Options-Focused Exchanges

- These specialize in listed options (contracts giving rights to buy/sell underlying assets):

- Cboe Options Exchange (Cboe) — The largest U.S. options marketplace.

- Nasdaq Options Exchanges (multiple) — Nasdaq owns/operates several options venues.

- Nasdaq operates a suite of six separate options trading platforms covering U.S. options markets.

- BOX Options Exchange (BOX) — Equity options exchange.

- MIAX Options Exchanges

- MIAX Options

- MIAX Pearl

- MIAX Emerald

- MIAX Sapphire (newer/expanding)

- NYSE American Options — NYSE’s listed options market.

- NYSE Arca Options — Another NYSE-owned options venue.

- MEMX Options — MEMX’s new options trading platform.

- Nasdaq PHLX (Philadelphia Stock Exchange) — Focused on equity & index options.

🧩 Dual-Role or Mixed Focus

- Some exchanges support both equities and options, often via separate market segments:

- NYSE Arca – trades stocks/ETPs and also offers options on Arca Options.

- NYSE American – equities + NYSE American Options.

- MEMX – started as equities but now offers MEMX Options.

- Nasdaq – primary equities venue but owns multiple options platforms.

📊 Major U.S. Futures Exchanges

- These are the primary active exchanges where futures contracts on commodities, financial instruments, interest rates, currencies, stock indexes, and other assets are listed and traded:

- Chicago Mercantile Exchange (CME) / CME Group

- The largest U.S. and global derivatives marketplace.

- Offers futures on equity indexes (e.g., S&P 500, Nasdaq), interest rates, FX, agricultural products, and more.

- Chicago Board of Trade (CBOT)

- One of the oldest futures exchanges (est. 1848).

- Now part of CME Group; trades agricultural, financial, and Treasury futures.

- Chicago Mercantile Exchange (CME) / CME Group

📊 Major U.S. Futures Exchanges (continued)

- New York Mercantile Exchange (NYMEX)

- Part of CME Group; specializes in energy and metals futures (e.g., crude oil, natural gas, gold).

- Commodity Exchange, Inc. (COMEX)

- Subsidiary of NYMEX/CME; focused on metals futures (e.g., gold, silver, copper).

- Cboe Futures Exchange (CFE®)

- Operated by Cboe Global Markets; offers futures including volatility and other innovative derivative products.

- ICE Futures U.S., Inc. (ICE US)

- Part of Intercontinental Exchange (ICE); lists futures on currencies, interest rates, and other products.

- North American Derivatives Exchange (NADEX / Crypto.com DCM)

- A CFTC-designated contract market that offers margined and (recently expanded) futures trading.

New Competition: Coinbase

- Traditional futures exchanges (like CME Group, ICE, etc.) have operated within long-established trading hours, product sets, and clearing systems. Coinbase is pushing boundaries in:

- Accessibility: 24/7 trading and perpetual contracts under regulation.

- Integration: Futures linked with broader trading services in one platform.

- Market structure: Influencing conversations about how futures markets might evolve in response to digital-native demand.

- Competition: Drawing institutional crypto derivatives volume back into U.S. regulated venues versus offshore platforms.

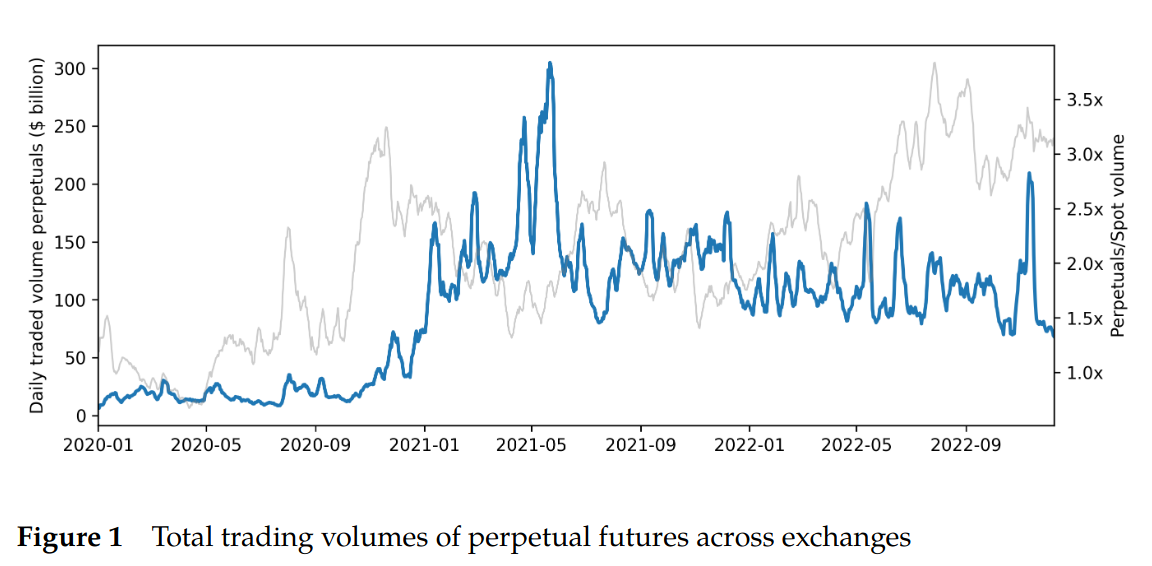

Evolution of Volume of Perpetual Futures